What Are ADUs?

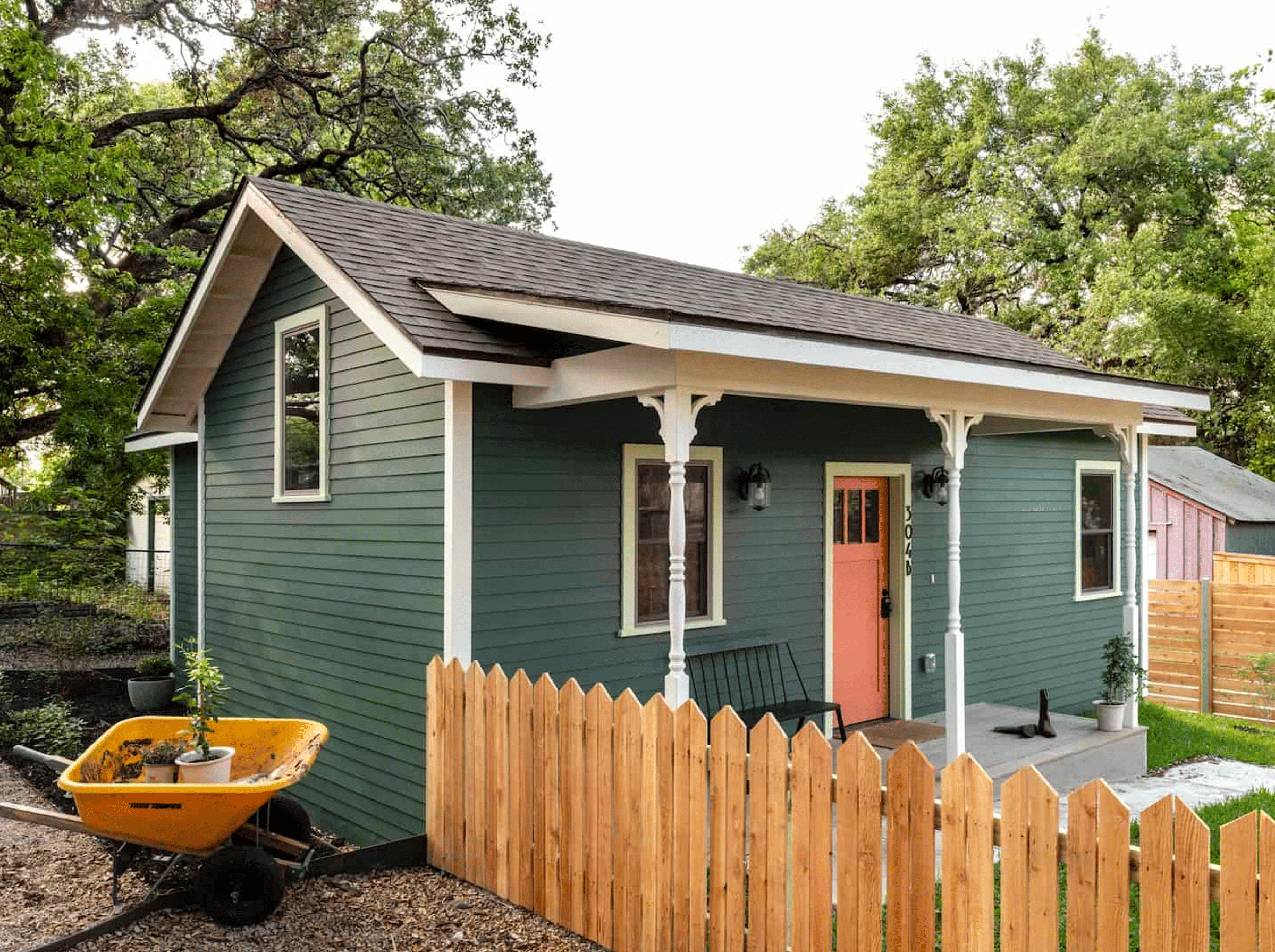

Usually called ADUs, accessory dwelling units are homes that are independent or have an attachment to the single-family home next to the same premises. These living plans are becoming a plausible way of solving family needs that are changing, increased household prices and modifications in ways of working among creative homeowners. You may have the idea of producing a detached backyard cottage, remodelling a garage, or completing a basement to serve as an independent apartment; in all cases, ADUs can customize any place to meet the changing needs. This versatility is one of the main factors in their recent breakthrough regarding their popularity in urban areas, where even a square foot matters.

For those wanting to move forward efficiently, working alongside an adu builder San Mateo can demystify regulations, design, and the construction process itself.Accessory Dwelling Units (ADUs) offer the chance to live with the generational diversity of your choice and earn some rental income or even an isolated workspace. They differ depending on the locality, and that is why professional advice is significant. ADUs bridge the gap between the existing homes and massive apartment buildings, providing their owners with flexibility and a chance to transform their buildings into something new.

Reasons to Consider an ADU

ADU is worth so much more than additional square feet. In light of this, residents across the nation have discovered in recent years that ADUs can alleviate cramped living conditions and allow for the construction of new household members without the need to relocate. The small-scale houses bring valuable chances of affordability and standing on their own, especially in urban and suburban surrounding areas, which are constrained by space. In almost all situations, ADUs allow families to be together and to live under the same roof: the old relative, newlywed couple, or college student are all living in it, but everyone has their privacy.

Another effective reason is the creation of new streams of income by homeowners who want to be financially secure. Long-term or short-term renting of an ADU can be used to subsidise a monthly mortgage or can be used as backup funds against a fluctuating economy. Meanwhile, homeowners enjoy enhanced value and salability of their property, and a flexible schedule is one variable that attracts most of the buyers. At the larger scale, society benefits, too: more people live in more housing, and these residents are able to sustain more of the population and local economy in the neighbourhood.

Planning Your ADU Project

An effective ADU project begins with a good plan that has a vision and the reality of the accomplishment. The important steps are:

1. Evaluating the property itself and determining some possible places where an ADU can be constructed, like an unused garage or a corner in a private yard.

2. Identifying priorities, such as housing family members or increasing privacy for tenants.

3. Be a competent budgeter, though the construction should be done depending on how much one wants to do it on design, the material to be used, labour, and connections to utilities.

4. Obtaining estimates from various contractors and consulting the knowledge and experience of designers to make sure that they are attainable.

5. Cases of the regulations of the city, the lot lines, and the HOA regulations that might influence the project.

It should be well prepared to eliminate surprises.

Ensure that the regulations you are operating within are on ADU size, setbacks and height restrictions code.

You may not need the features of aging-in-place at the moment, but these provide versatility and flexibility over the long term.

Consider built-in storage, multipurpose cabinets, and outdoor ease to optimise liveability.

Key Design Considerations

Design can either bring success or failure to any ADU, regardless of its size. Compact spaces require some smart and smart planning; consider the open kitchen systems that can lead into the living area, small spaces that can be transformed into work areas, and the bedrooms with some hidden space under the mattress. A small room can be converted into a bright one with high ceilings and big windows that will give it the impression of space, optimising light and atmosphere. In case of concerns about privacy, it may be the landscaping or fencing, or even finding entrances on opposite sides of the building.

The materials and finishes are also important: inexpensive to clean and durable surface materials keep costs of future repairs at a minimum, whereas energy-efficient windows and appliances reduce regular expenses. Future renters can also be attracted by smart-home technology that can make life more convenient on a daily basis. Taking into account tendencies in relation to micro-apartments and tiny houses, every inch can be used in various ways, including sleeping, relaxing and even entertaining. Properly designed ADUs are more livable and have higher resale value than their peer groups over time.

Navigating Zoning and Permits

Local zoning laws and permitting requirements are significant challenges for those looking to build Accessory Dwelling Units (ADUs).Variation presents itself in the form of rules for each city or neighbourhood on setbacks, sizes, lot coverage, and parking. The investigation of these local ordinances in advance will prevent the expensive delays or design modifications, which might be encountered later, the U.S. Department of Housing and Urban Development says. Other cities operate with shorter ADU permit processes in order to resolve their housing crunch, whereas others have a rigid design code. One way of coping with such processes is to employ qualified staff who can help you abide by all the structural and safety codes. A successful project of ADU requires proper planning.